registration question

#1

registration question

I was talking with a friend today who's been working on a 69 442. Nothing special but just did a repaint after a lot of body work. He had yet to have the title transferred so he went to registry in MA to transfer title and pay whatever sales tax. He told me he had to pay a little over 2k to register it because the registry uses Kelley blue book and it doesn't matter how much you paid for the car. He said they valued it at 28K and he could fight it but it probably won't matter. I asked him if he showed the bill of sale and he said they didn't want to see it?

I really find this hard to believe. How can they value a 69 442 in unknown condition at that price? I dont think he has lied to me in the past but I feel like he's pulling my leg?

I really find this hard to believe. How can they value a 69 442 in unknown condition at that price? I dont think he has lied to me in the past but I feel like he's pulling my leg?

#2

That's SOP for MA registry. If the cars been repainted, or he's done a lot of work to it, it's hard to fight. You CAN fight it, there's a form to appeal the sales tax on it. That said...I bought a 70 GS 455 'vert off ebay for around 25K about 5-6 years ago. When the car arrived, it needed a lot of work in my opinion. I figured it would take me 1 year or 1 1/2 years to fix it. So I didn't register it, I DID insure it. Anyways...I was telling a friend it would be ready soon and I would register it in the Spring. He said there's a penalty for not paying the sales tax when I bought it. A day or 2 later, I went to the MA registry and they told me there was a 750.00 penalty for the year and 1/2 on top of the regular sales tax for the 25K. Maybe that's what happened to your friend?

#4

yeah if i have something i havent regd I typically draw up a BOS for a recent date. if i can when i buy something i leave the date blank on the title and fill in a recent date there to. The other way is to pay sales tax and get a new title in your name when you buy it (you dont have to reg just get the title)

I agree w franks assesment, sales tax plus penalty. when i regd my 72 IIRC they assesed it at 3kish book value despite the value on my BOS being lower, if the BOS had stated a higher value bet money that would have been the sales tax number !!!!

Mass is so bent on sales tax that when my bud went to reg his ~$500 trailer from craigslist, they looked it up stated the previous owner never paid sales tax (cuz it was never regd) and before my bud could reg it the PO had to pay sales tax...OK my bud called the guy and told him

him but the guy was like i bought in NH, i only used it for storage im afraid youll have to pound sand if you think im gonna pay mass sales tax on it.

so he regd it as a homemade (no title on trailers under 2k Lbs I think is the rule) and payd sales tax on $250 instead of $500......

I agree w franks assesment, sales tax plus penalty. when i regd my 72 IIRC they assesed it at 3kish book value despite the value on my BOS being lower, if the BOS had stated a higher value bet money that would have been the sales tax number !!!!

Mass is so bent on sales tax that when my bud went to reg his ~$500 trailer from craigslist, they looked it up stated the previous owner never paid sales tax (cuz it was never regd) and before my bud could reg it the PO had to pay sales tax...OK my bud called the guy and told him

him but the guy was like i bought in NH, i only used it for storage im afraid youll have to pound sand if you think im gonna pay mass sales tax on it.

so he regd it as a homemade (no title on trailers under 2k Lbs I think is the rule) and payd sales tax on $250 instead of $500......

#5

I worked for many years at a car dealership here in Maynard. I've seen every one of the statements about the Mass DOT/Registry mentioned in this thread. All true.

EDIT: On second thought, I don't recall the Registry using Kelley Blue Book. Always been NADA. Same with banks and credit unions

EDIT: On second thought, I don't recall the Registry using Kelley Blue Book. Always been NADA. Same with banks and credit unions

Last edited by ignachuck; March 22nd, 2019 at 02:57 AM. Reason: Added comments

#6

Wow! what a rip! I thought Michigan was bad. I wonder how much tax has been collected on that 50 year old car! It probably sold new for $4000 or so new?? How many different owners? Everytime I have went to Michigan Secretary of State to transfer something they have took my declaration on the sales price, Of course I never tried to say I paid $50.00 for a 2 year old truck or similar. Actually I have always been completely honest with them..... yep....

#7

Mass took on charging sales tax on "VINTAGE COLLECTOR CAR VALUES" regardless of condition. However they do usually take the lower condition figure.Not that thats any consolation , They started doing this about 10 plus years ago. Does not matter what you paid for it period! Bill of sale or otherwise. Also you have 7 days from date of purchase to pay your sales tax or you pay a penalty. Leave the date blank on the title transfer until you are ready to avoid at least this fee. I have bought may project cars only to pay stupid sales tax money. I have tried in the past to fight it and even filed a complaint with the attorney general all to no avail . Government, gotta love it.

#8

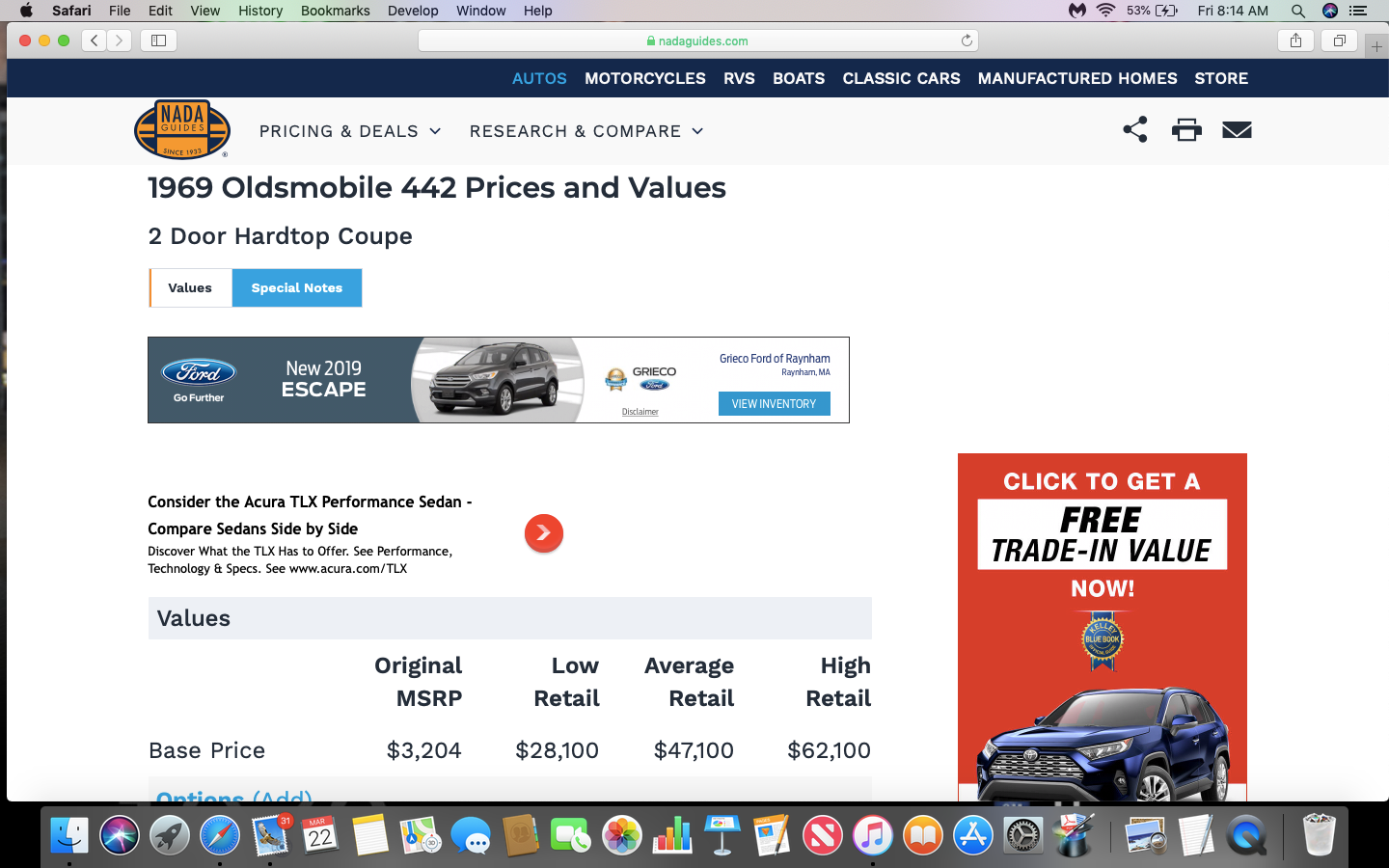

NADA values these cars at a premium which is based on their point scale. #1 being a trailer queen show car.So his 69 442 is worth 28k-62k. It doesn't even give you the option or a rating for a car that is a basket case or a total restoration. So my friend could have bought his 69 442 in pieces, wrecked, rusty, no engine or trans or interior etc... but as long as it has a title and if he wants to transfer title to own it and drive it, the least its worth is 28K?................WTF. You can see the MSRP is $3,200. That is UNBELIEVABLE! I wonder if insurance companies think the same if you had a claim?

Over the yrs Ive always paid taxes on the BOS or the book for newer cars.

Last edited by scrappie; March 22nd, 2019 at 05:31 AM.

#9

#10

Mass took on charging sales tax on "VINTAGE COLLECTOR CAR VALUES" regardless of condition. However they do usually take the lower condition figure.Not that thats any consolation , They started doing this about 10 plus years ago. Does not matter what you paid for it period! Bill of sale or otherwise.

#11

Well, there's another reason to not want to live in MA, thank you very much. That is INSANE. I have a big problem with government taxing sales of personal property like this. Collect fees for title transfer and registration all you want, no problem there. But continuing to collect sales tax on titled vehicles beyond the original NEW vehicle sales tax collected is horsesh*t.

Also, I would never entertain the idea of not immediately transferring the title of something into my name. This just opens the door for potential problems later, as evidenced by the penalty that MA imposes. Imagine a scenario where you bought a basket case W30, spent a lot of time and money restoring it to Concours condition, but you never transferred the title until all that work was complete. An unscrupulous previous owner then discovers you never transferred the title, and decides to claim you stole the vehicle, files a police report, and takes you to court. You misplaced the title, signed off by the previous owner, and the bill of sale. Sounds like a lot of fun, doesn't it?

Also, I would never entertain the idea of not immediately transferring the title of something into my name. This just opens the door for potential problems later, as evidenced by the penalty that MA imposes. Imagine a scenario where you bought a basket case W30, spent a lot of time and money restoring it to Concours condition, but you never transferred the title until all that work was complete. An unscrupulous previous owner then discovers you never transferred the title, and decides to claim you stole the vehicle, files a police report, and takes you to court. You misplaced the title, signed off by the previous owner, and the bill of sale. Sounds like a lot of fun, doesn't it?

#12

that very well could happen.another great thing about mass is the "excise" tax we have to pay every year on vehicles(cars,trailers) it used to be that the excise tax value would decrease every year to a minimum of $5 tax paid,i dont recall when it changed but the tax value now can never go below 10% of the original msrp.also a title in this state is $75,i have seen states with title fees of $4.

#13

I need to register my project car in Texas. The problem I might have is the car hasn't been registered since 1982, so it's no longer "active" in the State's computers and the seller is deceased. Anybody have experience with this situation in Texas? Thanks!

Rodney

Rodney

#14

that very well could happen.another great thing about mass is the "excise" tax we have to pay every year on vehicles(cars,trailers) it used to be that the excise tax value would decrease every year to a minimum of $5 tax paid,i dont recall when it changed but the tax value now can never go below 10% of the original msrp.also a title in this state is $75,i have seen states with title fees of $4.

#15

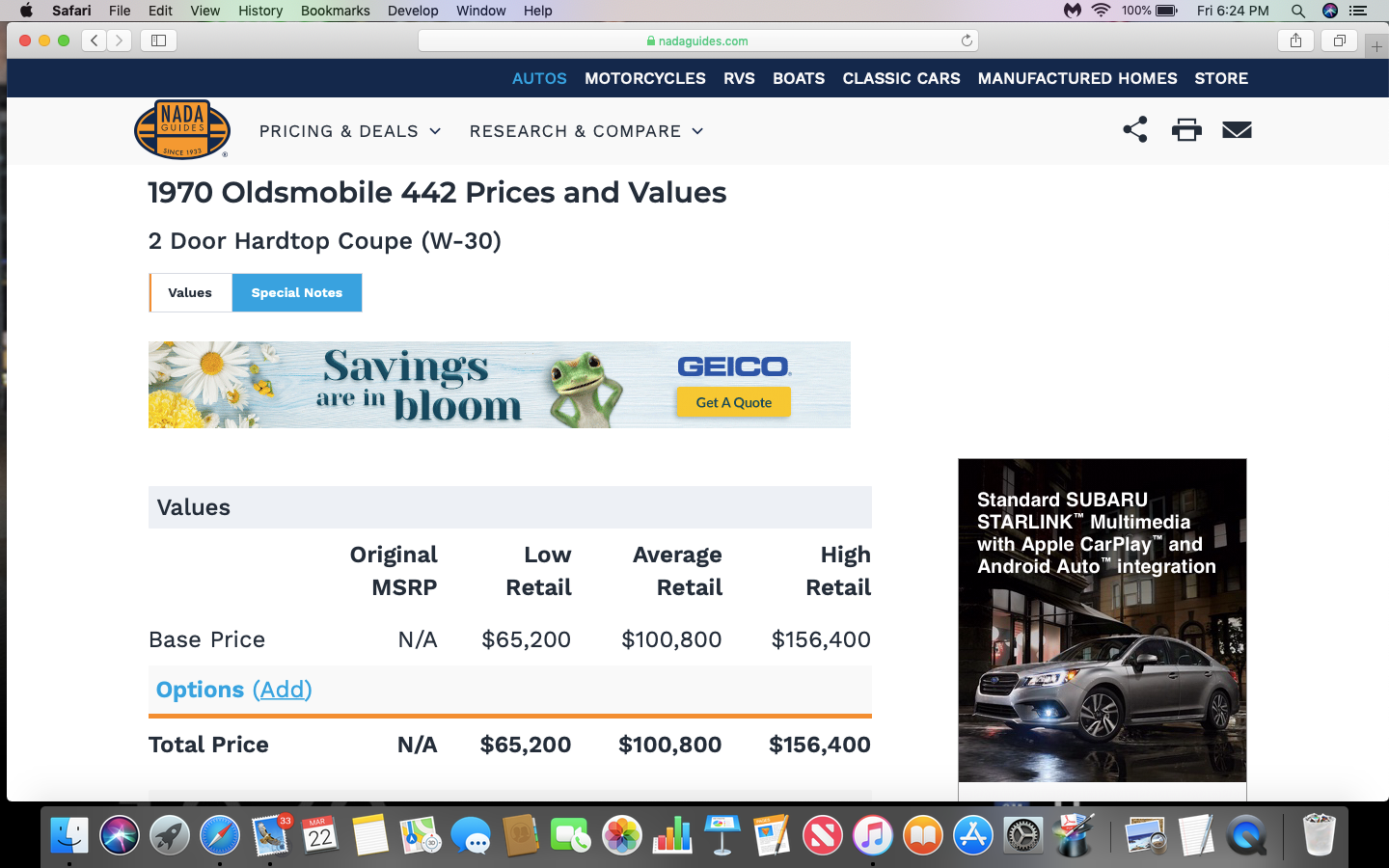

Check this out:

If I found a basket case 70 442 w-30 and was able to purchase it for whatever price. I knew that it needed everything : fenders, doors, quarters, floors, paint, engine/trans rebuilt, interior....everything no matter what the condition was. If I wanted to officially own this car,(title) after spending the money to buy this 50 yr old hunk of sh&t that I thought would be nice after spending yrs and tens of thousands more dollars, I would just have to give the registry in MA a minimum of $4,075 just to have a title with my name on it.

What happens when our generation dies off and nobody wants these cars anymore, will the value go down?

BTW if I was lucky enough to have a 1970 442 w-30 convertible it would cost me $9,400 to register that car in MA.

#16

Should include a 55 gal drum of vaseline. Remind me to never move to MA...and I thought I lived in the land of taxes GAH! That should be illegal. Way to promote the hobby Mass-a-2-shtz.

#18

mass-a-2-shtz i like that,never heard that one.i prefer mass-hole.and i dont know how it is legal what they do.i heard it was because people would put lower sale price to cheat the state out of sales tax money,so they in turn make some people pay more sales tax than they should.sounds logical/fair to me.i bought a 56 chevy out of arizona a five or so years ago(in-op no drive train) for $5k,when i registered it they made me pay sales tax on $8900.this is when i became aware of their new system.

#19

mass-a-2-shtz i like that,never heard that one.i prefer mass-hole.and i dont know how it is legal what they do.i heard it was because people would put lower sale price to cheat the state out of sales tax money,so they in turn make some people pay more sales tax than they should.sounds logical/fair to me.i bought a 56 chevy out of arizona a five or so years ago(in-op no drive train) for $5k,when i registered it they made me pay sales tax on $8900.this is when i became aware of their new system.

#20

Sales tax, excise tax, insurance...the real kicker here in MA is the inspection every year. I have 6 cars registered in MA now. That's not counting My GF's car. 2 are new and go average miles a year. 4 are old and go 1-3 K miles a year. Those 4 cars are all restored, new everything (brakes, tires, shocks, lights, front end). Every year I have to get those 4 cars inspected at $35.00 each. I have to watch some kid inspector jack up my restored front end and frame, worry where he's got the jack. I've had them snap lower ball joint grease fittings off doing that. I have to worry they are going to get in my white interior cars and get grease on them. Worry they will scratch my dash paint, stab my dash pad, put the sticker way too low so the next guy stabs my dash pad or scratches my dash, or leaves little bits of my old sticker in places I can't remove them. I have to worry they will chip my door opening it. They bitch about my license frames. You got to have your washers working. I go in a freshly detailed car, and I have to clean the outside of the windshield after I go get inspected. 'Course, always have to clean the inside, too because they never clean all the glue off or smear it around. Now in MA if your car is too high, or too low, they can reject it. State of MA gets a lot of $ from me for my cars each year, and our roads are really in poor shape here now.

#23

I'm fortunate that I can select any garage that has a state insp license. I have several friends who own licensed garages. I trust each of them. They will let me stand there while they go through the car. One of them specializes in Antique/Muscle cars. He's my go to. Never in a 100 years would I take it to a state or big box chain garage. I guess Im lucky I have that choice.

Eric...agreed...Im looking at getting the hell out of my current location for somewhere warm and dry within the next 5-10 years, Can't wait to flush this state and its weather/politics/policies/taxes etc...Not that that won't follow me anywhere I go. It will be easier to swallow the BS when it's sunny and dry 330 days out of the year and zero salt/cold/ and 200 days of gray gloom vs 200+ days of sunshine elsewhere.

Eric...agreed...Im looking at getting the hell out of my current location for somewhere warm and dry within the next 5-10 years, Can't wait to flush this state and its weather/politics/policies/taxes etc...Not that that won't follow me anywhere I go. It will be easier to swallow the BS when it's sunny and dry 330 days out of the year and zero salt/cold/ and 200 days of gray gloom vs 200+ days of sunshine elsewhere.

#24

here in iowa our tax is 5% on purchase this is the states basic tax rate for everything.so a 10k car will cost ya 500 bucks.50k car 2500 bucks.title fee is 25 bucks then yearly fees are prorated as they age,once they hit 15 yrs it bottoms out,all my cars are 50 bucks a year.and my 66 chevelle that i had before they changed the system only costs me 16 bucks a year.

#25

Sales tax, excise tax, insurance...the real kicker here in MA is the inspection every year. I have 6 cars registered in MA now. That's not counting My GF's car. 2 are new and go average miles a year. 4 are old and go 1-3 K miles a year. Those 4 cars are all restored, new everything (brakes, tires, shocks, lights, front end). Every year I have to get those 4 cars inspected at $35.00 each. I have to watch some kid inspector jack up my restored front end and frame, worry where he's got the jack. I've had them snap lower ball joint grease fittings off doing that. I have to worry they are going to get in my white interior cars and get grease on them. Worry they will scratch my dash paint, stab my dash pad, put the sticker way too low so the next guy stabs my dash pad or scratches my dash, or leaves little bits of my old sticker in places I can't remove them. I have to worry they will chip my door opening it. They bitch about my license frames. You got to have your washers working. I go in a freshly detailed car, and I have to clean the outside of the windshield after I go get inspected. 'Course, always have to clean the inside, too because they never clean all the glue off or smear it around. Now in MA if your car is too high, or too low, they can reject it. State of MA gets a lot of $ from me for my cars each year, and our roads are really in poor shape here now.

I'm semi retired now so I only do about 25 or so Mass state inspections a week now. There are five other mechanics in our shop who are also licensed. I can tell you that we all have at least one "classic"car. So we show a great deal of respect for those cars. Often we ask the customer to drive the car into the bay, and show us where they would like us to jack it. I clean the spot where the sticker goes and sometimes let the customer put the sticker on themselves. Inspecting a classic car takes a lot longer than a "modern" car because we end up gabbing about old cars and stuff.

Last edited by ignachuck; March 25th, 2019 at 02:17 AM.

#26

Here in VA if you register with antique plates, state inspection is not required, and once you pay the one time fee of 50 bucks, no personal property tax and no yearly registration renewal.

#27

Toytown is Winchendon, MA. I have a place there, but I'm mostly in our Seekonk place because it has more garage space. I do know a garage in Orange owned by a guy with maybe 20 classics. He's very active with Cruzin' Mag and a member of the club I belong to in Orange. He would do a good job for me, because he knows my cars and how I take care of them. I used to go there, but moved most of my cars to Seekonk now. It's harder down here, because they are busier shops. I'm glad you take care of some of us Frank! I know there's no real $ in doing it for you guys. I'm going to start thinning the herd soon. Maybe cut back to one new car, one new or recent muscle car, and one old car. It's just weird for me because I'm 65 and in the old days there were always old car people in the garages. Now it's young people who get excited if you have a new Civic or something like that!

#29

Same in Texas. The state goes by "blue book" value to determine taxes. No matter what you paid or what the car is worth. The way around this is to just transfer the title without registering it for highway use until you can afford to pay the tax.

#30

#31

Yes Frank, once the toy capital of the US, next to Gardner. Here in MA, I think registration for 2 years is $60.00. If you want an antique plate, or YOM plate, it's $50.00 a year. For me, it's not really about the $, but it's annoying to spend lots of time getting my cars inspected, renewing plates, paying excise tax(s)...it's a very greedy state we have here. It's not a car-friendly state. The roads, so many cars on the roads, each year I can notice an increase of traffic. Hell, jcdynamic88 (Jim) and I grew up drag racing on an interstate highway in the late 60's...there was no traffic at night. Now, that highways are busy, 24/7. What can you do?

Thread

Thread Starter

Forum

Replies

Last Post

Starfire61

General Discussion

17

March 24th, 2008 06:01 AM